City Debt

Guided by the City’s financial management policies, the City of Mercer Island retains the highest possible bond rating from Moody's Investors Service: Aaa (“triple A”) rating on the City’s unlimited tax general obligation (UTGO), or voted, bonds and limited tax general obligation (LTGO), or non-voted, bonds. This high bond rating enables the City to secure lower interest rates, thereby reducing debt service costs.

The City can issue five types of debt which have legal limits set by the State. The five types of debt include:

- Voted general obligation bonds

- Non-voted general obligation bonds

- Revenue bonds

- Lease debt

- Loans

For the purposes of the legal limit debt calculations, leases and loans are included with the non-voted general obligation debt limits. A schedule of all the City debt classified by type is included later in this section.

Voted Debt

Voted debt must be approved by registered voters via a ballot measure, with an additional (e.g., excess) property tax levy dedicated to paying the annual debt service costs. Voted debt has typically been used to fund large public buildings and to buy land or open space. The City currently has no voted debt outstanding.

Non-Voted Debt

Non-voted debt must be approved by the City Council, with the general tax revenues of the City used to pay the annual debt service costs. Non-voted debt includes not only bonds but also any loans and lease obligations of the City.

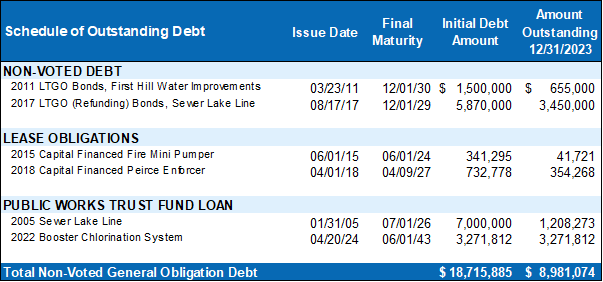

The active issues are described below.

- 2011 LTGO First Hill Water Improvements – In 2011, the City issued $1.5 million in LTGO bonds to fund a portion of a water system improvements project in the First Hill neighborhood. Water utility rate revenues are being used to repay the long-term debt.

- 2015 Fire Apparatus Lease (Mini Pumper) – In 2015, the City Council authorized the purchase of a Mini Pumper Truck from Pierce Manufacturing through a 9-year lease purchase financing agreement with Municipal Asset Management for $341,295. The remaining principal will be paid off in 2024.

- 2017 LTGO Refunding, Sewer Lake Line – In 2009, the City issued $9.4 million in LTGO bonds to fund a portion of the sewer lake line replacement project. To save on interest costs, this bond issue was refunded in 2017. Sewer utility rate revenue is being used to repay the long-term debt.

- 2018 Fire Apparatus Lease (Enforcer Pumper) – In 2018, the City Council authorized the purchase of an Enforcer Pumper Truck from Pierce Manufacturing through a 9-year lease purchase financing agreement with Municipal Asset Management for $732,778.

Public Work Trust Fund Loans

In addition to the above debt, the City has two long-term loans outstanding at the end of 2023 via a Public Works Trust low-interest loans administered through the State of Washington Department of Community Development.

In 2005, the City received a $7.0 million in Public Works Trust Fund loan to pay for a portion of the sewer lake line replacement project. A balance of $1.2 million remains outstanding at the end of 2023.

In November 2022, the City was awarded $3.27 million in Public Works Trust Fund loan to fund the Booster Chlorination System project. The City took receipt of the funds in April 2024 after the project’s completion.

Water utility rates are being used to repay long-term debt. The debt service term is twenty years with a 0.9% interest rate. The total principal balance outstanding at the end of 2024 will be $3,271,812.

Schedule of Debt Outstanding

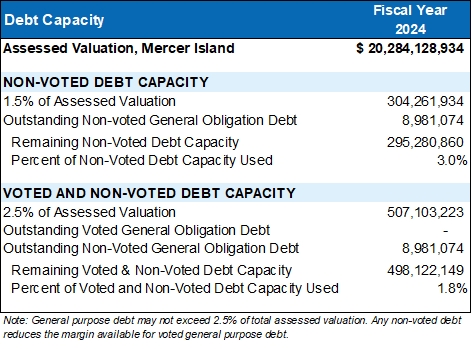

Debt Capacity

The debt capacity of the City is limited by law. Below is a chart showing the computation of the debt capacity as of January 1, 2024.